COUNTRY COFFEE PROFILE: VIETNAM

After 30 years of development, Vietnam's coffee industry is facing severe challenges such as climate change; competition of other crops; need to replace ageing coffee trees; production costs are increasing higher while world coffee prices are at very low levels. Due to intense competition, Vietnam's policy of coffee production has shifted to a new era with two objectives: firstly, to maintain its position as the world’s second largest producer and exporter of coffee green beans; secondly, to double the added value in coffee production by increasing productivity, quality and value addition.

CONTENTS

Preface .............................................................................................................................4

Foreword ..........................................................................................................................5

Summary ..........................................................................................................................6

- Background ...............................................................................................................7

1.1. Geographical setting of Vietnam ...................................................................................7

1.2. Economic setting ........................................................................................................8

1.3. Summary of the history of coffee in Vietnam ..................................................................9

- Coffee production ..................................................................................................... 10

2.1. Types of coffee and coffee-growing areas ................................................................. 10

2.2. Production systems ................................................................................................14

2.3. Volume of production .............................................................................................15

2.4. Coffee processing ..................................................................................................16

- Coffee exports performance during the last five years ....................................................18

3.1. Volume and value of exports ...................................................................................18

3.2. Exports by destination .......................................................................................... 19

3.3. Coffee and trade balance ....................................................................................... 20

3.4. Share of coffee in Gross Domestic Product ............................................................... 21

- Stakeholders in the coffee sector ............................................................................... 21

4.1. Farmers’ associations/cooperatives ......................................................................... 21

4.2. Government involvement ...................................................................................... 23

- Prospects for coffee production ................................................................................. 23

5.1. An assessment of difficulties faced by the sector ...................................................... 23

--------------------------------------------------------------

LIST OF ACRONYMS

4C Common, Code, Coffee, Community

ADB Asian Development Bank

AGROTRADE Agro Processing and Market Development Authority of Vietnam

DCP Department of Crop Production of Vietnam

GDP Gross Domestic Product

GSO General Statistics Office of Vietnam

ICD International Cooperation Department

ICO International Coffee Organization

MARD Ministry of Agriculture and Rural Development of Vietnam

RFA Rainforest Alliance

SCA Specialty Coffee Association of America

SOE State-owned Enterprises

VCCB Vietnam Coffee Coordination Board

VCCI Vietnam Chamber of Commerce and Industry

VICOFA Vietnam Coffee – Cocoa Association

WASI Western Agroforestry and Scientific Institute of Vietnam

WB World Bank

LIST OF TABLES

Table 1: Vietnam’s key economic data ........................................................................ 9

Table 2: Areas of coffee cultivation (by provinces and hectares) .................................. 13

Table 3: Coffee output of Vietnam ............................................................................16

Table 4: Vietnam’s coffee export ............................................................................. 19

Table 5: Main export destination of Vietnam’s coffee .................................................. 20

Table 6: Vietnam’s coffee export and trade balance ................................................... 21

Table 7: Share of coffee in GDP .............................................................................. 21

LIST OF FIGURES

Figure 1: Vietnam’s GDP growth rate .......................................................................... 8

Figure 2: Quality test scores of new Robusta varieties by SCA ....................................... 11

Figure 3: Quality test scores of new Arabica varieties by SCA ........................................ 11

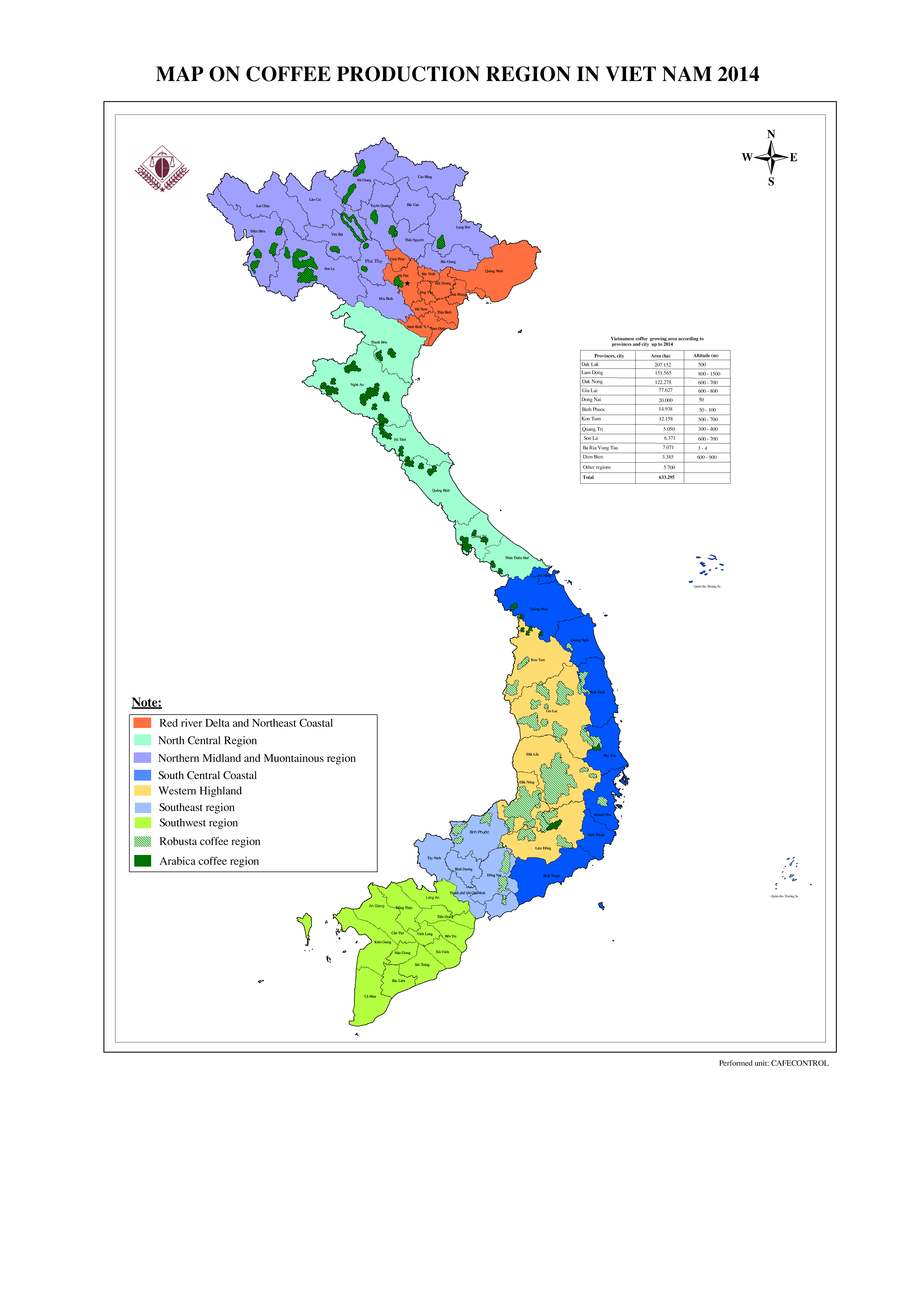

Figure 4: Map of coffee – producing areas .................................................................. 12

Figure 5: Green Robusta price .................................................................................. 18

----------------------

PREFACE

From producing less than two million bags per year in the early 1990s, Vietnam has emerged as the second largest coffee-producing and -exporting country in the world, with an average annual output that currently exceeds 25 million 60-kg bags. This remarkable achievement has been spearheaded by a positive government policy that created an enabling environment for the coffee sector to develop. I was, therefore, extremely pleased to receive a request from Vietnamese coffee authorities to work together in the preparation of this country coffee profile. This work will provide delegates, researchers and all stakeholders in the world coffee sector with a better understanding of the dynamic nature of the coffee industry in Vietnam.

Country profiles meet one of the objectives of the International Coffee Agreement 2007, specifically collecting, disseminating and publishing economic, technical and scientific information, statistics and studies, as well as the results of research in coffee matters. These objectives were reinforced in the Five-year Action Plan approved by the International Coffee Council during its 120th Session, held in Yamoussoukro (Côte d’Ivoire) in September 2017.

To prepare these country profiles, ICO Members are provided with guidelines to be used as a framework for a comprehensive report on the coffee sector in specific countries. Therefore, these profiles are extremely important in improving the visibility of the world coffee economy, and understanding its challenges and opportunities. They also provide a reference for policy-makers and coffee stakeholders, as well as promoting further analysis and serving as a background for the preparation of development projects.

I would like to thank Mr. Luong Van Tu, Chairman of the Vietnam Coffee & Cocoa Association (VICOFA), and his technical staff for initiating and coordinating the preparation of the substance of the report, as well as for their invaluable contributions and fruitful cooperation. In all cases efforts have been made to provide an objective analysis based on form and reliable data.

I am sure that this profile will be of interest and value to our Members, as well as to all stakeholders in Vietnamese coffee industry in and abroad. Finally, the ICO Secretariat and I remain open to any observations and suggestions that will contribute to increasing the quality and the dissemination of out series of Coffee Country Profiles.

José Sette

Executive Director

International Coffee Organization

----------------------------------------

FOREWORD

Vietnam is a country located in Southeast Asia with tropical and subtropical climate. There is a large area of red soil basalt suitable for coffee growing which was brought by the French in 1857. Within 100 years, the area reached only 30,000 hectares.

Since 1975, after the re-unification of the country, the Government of Vietnam has focused resources to the development of coffee production. By the early 2000s, Vietnam became the second largest producer and exporter of coffee beans in the world. Coffee accounts for 10% of agricultural export turnover, contributing 30% of GDP in the Central Highlands.

After 30 years of development, Vietnam's coffee industry is facing severe challenges such as climate change; competition of other crops; need to replace ageing coffee trees; production costs are increasing higher while world coffee prices are at very low levels. Due to intense competition, Vietnam's policy of coffee production has shifted to a new era with two objectives: firstly, to maintain its position as the world’s second largest producer and exporter of coffee green beans; secondly, to double the added value in coffee production by increasing productivity, quality and value addition.

Domestic and international coffee producing enterprises will invest more in processing of roasted and ground coffee, soluble and other intensive processed products for export in order to increase export turnover to USD 6 billion in the next ten years. Especially, production of sustainable coffee should be ensured to meet the requirement of the domestic and international consumers.

This Profile provides an overview of Vietnam’s coffee industry.

I would like to thank the agencies and individuals for their cooperation in providing information for this Profile, thanks also go to ICO for supporting this publication.

LUONG Van Tu

Chairman

Vietnam Coffee – Cocoa Association

---------------------------------------------------------

SUMMARY

Vietnam is a densely populated country located in South-East Asia sharing land borders with China (North), the Lao People’s Democratic Republic (North-West) and Cambodia (West). Sea borders include the Gulf of Thailand, the Gulf of Tonkin and the Pacific Ocean. The country covers a total area of 331,698km2 with a population of over 96 million. The climate is divided into three distinct zones, including subtropical humid climate in the North, tropical monsoon climate in Central and South-Central regions and tropical savannah in the Central and Southern region. Annual rainfall ranges from 1,200mm to 3,000mm, with annual temperature varying between 5oC from December to January and 37oC from April to May. The country is endowed with lands and climate favourable to agriculture, including rice, coffee, rubber, tea, pepper, soybeans, cashews, sugar cane, peanut, banana and many other agricultural products. Economic and political reforms undertaken in the late 1980s have led to a rapid economic development, such that Vietnam has become a lower middle-income country with annual GDP growth among the highest in the world.

Introduced by French missionaries in 1857, coffee cultivation has become entrenched in Vietnamese culture. Boosted by assistance from the government, coffee production increased from very low levels in the early 1990s to over 25 million 60-kg bags, becoming the second largest producing country in the world. The two main types of coffee (Robusta and Arabica) are produced in the country but Robusta accounts for 97% of total production. Total areas covered by coffee farming are estimated at 600,000ha, with the main coffee provinces situated in the Central Highlands, including Dak Lak (190,000 ha), Lam Dong (162,000 ha), Dak Nong (135,000 ha), Gia Lai (82,000 ha) and Kon Tum (13,500 ha). Other relatively small producing provinces are situated in the North-Western mountain, South-Eastern and North-Western regions. It should be noted that the Government has taken measures to stabilize coffee production areas at a maximum level of 600,000ha and efforts are now directed towards improving the quality of premium coffee beans. The production system is dominated by the unshaded method, although some farms include shade trees. Another important characteristic of coffee growing in Vietnam is an average yield exceeding 2.3 metric tonnes per hectare, one of the highest in the world.

The average value of coffee exports is around US$3 billion per year, accounting for over 10% of the country’s total agricultural exports, although representing only 1.2% of the total value of all commodities, goods and services exports. Vietnam’s main export destinations are Germany, Indonesia, Italy, Japan, Russian Federation, Spain and the United States of America,

Finally, one of the main challenges of the Vietnamese coffee sector is its limited domestic consumption and small processing activity. Other important challenges are climate change, which is exacerbating the spread of pests and diseases, and ageing coffee trees.

- BACKGROUND

1.1. Geographical setting of Vietnam

Vietnam is a country located in Southeast Asia on the east side of Indochina Peninsula with an area of 331,698km2, with geographic coordinates: 16 10 N, 107 50 E. It is a country of tropical lowlands, hills, and densely forested highlands. Three quarters of the country’s land area is hilly and mountainous. The highest point in Vietnam is Fansipan in the northwest at 3,143m. The Red river delta in the North has an area of around 15,000km2 and the Mekong river delta in the South covers around 40,000 km2.

Within the southern portion of Vietnam is a wide plateau known as Tay Nguyen ‘Central Highlands’, approximately 51,800 km2 of rugged mountain peaks, extensive forests, and rich soil. Comprising five relatively flat plateaus of basalt soil spread over five central provinces, the Central Highlands account for 16% of the country's arable land and 22% of its total forested land.

Vietnam’s natural resources include coal, iron, bauxite, and precious stones, which are mined in northern and central Vietnam, and large reserves of oil and gas in the coastal area.

Although Vietnam's territory is located in the tropics, Vietnam's climate is divided into three distinct climatic zones according to the Köpenick climate classification, with subtropical humid climate in the North and North Central regions, tropical monsoon climate in Central and South Central regions, and tropical savanna in Southernmost Central and Southern regions. At the same time, it is directly affected by the monsoon climate in the low latitude regions. There are four seasons in the North: spring, summer, autumn and winter; and two in the South: rainy and dry seasons. Humidity averages 84% throughout the year. Annual rainfall ranges from 1,200mm to 3,000mm, and annual temperatures vary between 5oC (December and January) and 37oC (April and May). Seasonal divisions are more clearly marked in the northern half than in the southern half of the country.

Under the influence of monsoons and complicated topography, the climate in Vietnam always changes within one year, between years, between the regions from North to South and from low to high altitudes.

1.2. Economic setting

Vietnam is a developing economy in the Southeast Asia. Its development record over the past thirty years is remarkable. Economic and political reforms under ‘Doi Moi’, launched in 1986, have spurred rapid economic growth and development and transformed Vietnam from one of the world’s poor nations to a lower middle-income country. The GDP growth rate in Vietnam averaged 6.25% from 2000 until 2018, reaching an all-time high of 8.46% in the fourth quarter of 2007 with a low of 3.14% in the first quarter of 2009.

In recent years, the nation has been advancing as a leading agricultural product exporter and an attractive foreign investment destination. Vietnam's key products are: rice, cashew nuts, coffee, tea, black pepper, fish products and rubber. Manufacturing, information technology and high-tech industries constitute a fast growing parts of the economy. Vietnam is also one of the largest oil producers in the region.

Figure 1: Vietnam’s GDP growth rate

Driven by higher growth in agriculture and services, especially the buoyant expansion of services boosted by tourism and the banking and financial sector, Vietnam’s medium-term forecast remains upbeat. Inflationary pressures will remain moderate and the current account is expected to remain in surplus, Driven by strong domestic demand, as well as robust export-oriented manufacturing, economic growth is estimated at around 6.8%.

Table 1: Vietnam’s key economic data

| 2013 | 2014 | 2015 | 2016 | 2017 |

89.8 | 90.7 | 91.7 | 92.7 | 93.6 | |

1,893 | 2,029 | 2,033 | 2,110 | 2,355 | |

171.22 | 186.20 | 193.24 | 205.28 | 223.86 | |

5.4 | 6.0 | 6.7 | 6.2 | 6.8 | |

4.6 | 5.1 | 0.3 | 4.6 | 2.9 | |

7.7 | 9.4 | 0.6 | 9.0 | 6.4 | |

0.4 | 0.8 | - 4.1 | 2.1 | 2.9 | |

133 | 150 | 162 | 177 | 215 | |

133 | 149 | 166 | 174 | 212 |

Source: ADB & WB

1.3. Summary of the history of coffee in Vietnam

Arabica (Coffea arabica) was the first coffee variety to have been introduced into Vietnam in 1857, through French missionaries. It was tested in Catholic churches in northern provinces, such as Ninh Binh, Thanh Hoa, Nghe An and Ha Tinh; and then spread to some central provinces, such as Quang Tri and Quang Binh. Finally, coffee was brought to southern provinces of the Central Highlands and the Southeast. Then people discovered that the Central Highlands was the most suitable place to cultivate coffee.

Later, in 1908, the French brought two other varieties of coffee to Vietnam, namely Robusta (Coffea canephora) and Exelsa (Coffea exelsa). They then introduced various other varieties from the Congo to the Central Highlands. Coffee grows very well in this region, and the area under coffee expanded. During the war and until 1986, the coffee producing area grew, but only slowly and output was low. In 1986, the total area of the country devoted to coffee production was only about 50,000ha and the volume of production was 18,400 tonnes (just over 300,000 60-kg bags).

Since 1986, the Government of Vietnam has concentrated its resources on investing in the coffee sector, aiming to make coffee a key agricultural industry. In addition to state-owned farms, the Government also encourages individual households to grow coffee. As a result, coffee production in Vietnam has boomed in terms of area, output and export value.

The Central Highlands became the largest Robusta production area in terms of acreage and yield. It is famous not only in Vietnam, but also all over the world. This area has many legends about coffee such as the Buon Ma Thuot brand. There are some geographic indications of the coffee regions (‘Buon Ma Thuot’, ‘Cau Dat - Da Lat’ and ‘Son La’) known for their quality, sweet aroma, strong flavour resulting from the soil characteristics.

- COFFEE PRODUCTION

2.1. Types of coffee and coffee-growing areas

In terms of coffee, Vietnam became the leading producer of coffee in Southeast Asia and, after Brazil, the world's second producer and exporter of green coffee beans by the late 1990s. However, production was largely focused on Robusta beans. While Robusta accounts for 92.9% of the total coffee growing area, Arabica varieties are responsible for only a few percent. Robusta accounts for 97% of Vietnam's total output volume.

Regarding Robusta (Coffea Canephora), the majority of Robusta varieties currently grown in Vietnam originate from Indonesia's Java Island. However, Vietnam now plants two main varieties of Robusta. Firstly, the original Robusta variety of small-sized beans and high quality is grown in some regions, but with limited acreage due to low yields and weak resistance to pests and diseases. The second kind are the so-called high-yield varieties.

Since the early 1990s, when coffee was widely grown in the Central Highlands provinces, various agricultural seedling research institutes, particularly the Western Highlands Agriculture & Forestry Science Institute (WASI), have researched hybridizing and grafting various Robusta varieties. This has been done in order to create and select dozens of different new Robusta varieties of healthy growth, adaptability to soil and climate, high resistance to pests and diseases (hemileia vastatrix) and high yields of 3.5 tonnes per ha or more. Typical multi-variety late ripening hybrids and varieties had been named by Vietnamese researchers as clone TR4, TR5, TR6, TR7, TR8, TR9, TR11, TR12, TR13, TR14 and TR15 or TRS1. Three of these clones are the most favoured and widely cultivated by Vietnamese coffee growers recent years. These are clones TR14 and TR15, which adapt very well to changes in climate, and TRS1, which copes well with the need to respond quickly to replanting programmes.

Vietnam’s new Robusta varieties with a total score of 70 or higher are high-quality coffees in accordance with standards of the Specialty Coffee Association (SCA).

Figure 2. Quality tested scores of new Robusta varieties by SCA

Source: WASI, 2018

Regarding Arabica (Coffea Arabica), almost 99% of the Arabica coffee grown in Vietnam is of the Catimor variety, a cross-breed between Timor (Robusta) and Caturra (Arabica). However, in parallel with varieties of Robusta, Vietnamese researchers have also, over the past twenty years, hybridized and grafted to put into production of various new Arabica varieties with names beginning in THA... or TN..., which are adaptable to the local soil and climate, and have high productivity and increased resistance to pests and diseases.

Regarding Arabica (Coffea Arabica), almost 99% of the Arabica coffee grown in Vietnam is of the Catimor variety, a cross-breed between Timor (Robusta) and Caturra (Arabica). However, in parallel with varieties of Robusta, Vietnamese researchers have also, over the past twenty years, hybridized and grafted to put into production of various new Arabica varieties with names beginning in THA... or TN..., which are adaptable to the local soil and climate, and have high productivity and increased resistance to pests and diseases.

The quality according to SCA standards of some new Arabica varieties reached over 80 points, and is graded as specialty coffee. These varieties, after replacing Catimor, will help improve the quality of Vietnamese Arabica.

Figure 3. Quality tested scores of new Arabica varieties by SCA

Source: WASI, 2018

Vietnam’s coffee is grown in the regions at between 500 to 1,200 meters above sea level, so that its coffee flavour has a sweet smell. This was approved at the First International Roasted Ground Coffee contest held in Paris in 2015 by the Agency for the Valorization of Agricultural Products (Agence pour la Valorisation des Produits Agricoles (AVPA)) and the Improvement Agriculture Products Value Association, where the SOBICA Joint Stock Company of Vietnam was awarded a Silver Medal for AROMA coffee product (mixture of the three best Arabica coffees of Vietnam), and Bronze Medal for intensive coffee product (mixture of Arabica Bourbon from Cau Dat - Da Lat and Robusta from Buon Ma Thuot).

Figure 4: Map of coffee-producing areas (2014)

The Government of Vietnam has recently launched a number of initiatives to improve the quality of coffee for exports, including the widespread cultivation of Arabica. The coffee growing area has been rapidly expanding and yields increasing, together with the improvements in the quality of coffee beans. The Ministry of Agriculture & Rural Development of Vietnam (MARD) has affirmed the need to find solutions to maintain the coffee cultivation area stable at 600,000 hectares. Vietnam now needs to restrict the expansion of its area under coffee, while improving the quality of its coffee beans.

Table 2: Areas of coffee cultivation (by provinces and hectares)

Provinces | 2013 | 2014 | 2015 | 2016* | 2017* |

Northwestern Mountain Region | 13,800 | 15,300 | 15,900 | 17,500 | 17,500 |

Son La | 9,900 | 11,200 | 11,700 | 12,000 | 12,000 |

Dien Bien | 3,800 | 4,000 | 4,100 | 4,500 | 4,500 |

Central Coastal Region | 8,800 | 9,200 | 9,200 | 10,000 | 10,000 |

Quang Tri | 4,700 | 4,700 | 4,800 | 5,100 | 5,100 |

Phu Yen | 1,400 | 1,400 | 1,400 | 1,400 | 1,400 |

Binh Thuan | 1,800 | 1,800 | 1,800 | 1,800 | 1,800 |

Central Highlands | 559,400 | 573,000 | 577,700 | 583,000 | 583,000 |

Dak Lak | 199,900 | 203,700 | 204,400 | 209,000 | 190,000 |

Lam Dong | 151,500 | 157,300 | 158,800 | 154,000 | 162,000 |

Dak Nong | 116,900 | 118,800 | 119,500 | 126,000 | 135,000 |

Gia Lai | 77,700 | 79,100 | 79,700 | 80,000 | 82,500 |

Kon Tum | 13,400 | 14,100 | 15,300 | 14,000 | 13,500 |

Southeastern Region | 42,100 | 43,800 | 42,400 | 51,700 | 51,700 |

Binh Phuoc | 15,200 | 15,800 | 15,900 | 16,000 | 16,000 |

Dong Nai | 19,400 | 20,400 | 19,700 | 21,000 | 21,000 |

Ba Ria - Vung Tau | 6,600 | 6,700 | 6,500 | 7,000 | 7,000 |

Total | 623,900 | 641,300 | 645,200 | 662,200 | 662,200 |

*Estimate

Source: MARD of Vietnam

In terms of coffee cultivation technology for sustainable development, various Vietnamese coffee farmers have been applying advanced agricultural production technology to obtain the national and international certifications, such as 4C (Common Code for the Coffee Community); VietGAP (Vietnamese Good Agricultural Practices); UTZ (UTZ Certified); and RFA (Rainforest Alliance). By the end of 2017, more than 200,000ha, accounting for more than 30% of the total coffee growing area of Vietnam, were certified by sustainable development initiatives. According to the Department of Crop Production (DCP)) of MARD, only 10% of the total volume of coffee had such certifications in 2011; however this had increased to approximately 50% of the total volume by 2014. This meant that around 300,000ha, equivalent to 600,000 tonnes of green coffee, were certified by 4C, UTZ and RFA.

2.2. Production systems

Arabica is suitable for cultivation in the mountainous regions at high altitude where the temperature ranges between 20°C and 22°C and the annual rainfall is 1,300 – 1,900mm.

Robusta is cultivated in the highlands and plains, with hot weather, high humidity and weak direct sunlight, with temperatures between 24°C and 26°C.

In Vietnam, there are specialized farms, specializing in only one crop, and diversified farms, with more than one farming product. Moreover, there are two main types of diversified farms. The first is farms where different crops share or co-locate in the same plot of land. This is called a synchronized farming system; it means intercropping of coffee trees with other industrial crops. The second type is where different crops are planted in separated plots of land. This is called a segregated farming system.

Density for Arabica coffee varies from 2,660 to 6,660 trees per ha, depending on the varieties, soil properties and slope of the growing hills. For Robusta coffee the density is about 1,330 trees per ha. Planting starts during the rainy season. Although planting may cease at the end of the rainy season, sufficient water still needs to be provided. Trees for shading and wind protection for coffee need to be planted. Shading trees should be not too dense and should always reach a height of between 2 and 4 meters above the tops of the coffee trees, so that the coffee trees below can receive sunlight.

For the purpose of shading trees and ensuring stable income of the coffee growers, after a period of pilot planting, the Ministry of Agricultural and Rural Development introduced a technical process of intercropping with some other industrial crops, such as pepper, fruit trees, avocado, durian and macadamia in the coffee gardens.

These shade trees not only help to diversify products, create more jobs, limit price risks and market fluctuations, as well as increase income for farmers, but can also be used for shading, windbreaks, evaporation limitation and moisture retention to contribute to the sustainable development of coffee farms in the context of climate change. Up to now, over 100,000ha of such diversified farms have been developed in Vietnam, mostly in the Central Highlands.

In order to limit the expansion of coffee areas and to increase the quality, volume and revenue of coffee production, the Vietnamese Government has already mapped out an overall plan of reviewing and rezoning coffee areas country-wide, replacing old coffee trees with new varieties or facilitating a switch to other crops in regions not suitable for coffee growing.

Robusta continues to grow in four provinces in the Central Highlands: Dak Lak, Lam Dong, Dak Nong and Gia Lai with a total area of 530,000ha, and about 70,000ha in other provinces. Planting Arabica cultivation has been supported in Son La (Northwest Vietnam), Nghe An, Quang Tri (Central Provinces) and Lam Dong (Central Highlands) and some other central regions that are suitable for Arabica varieties.

The country continues to encourage investment in research for the selection and introduction of high-yielding and high-quality coffee varieties, and to provide sufficient seedlings for nurseries to meet production requirements.

2.3. Volume of production

From 1986 to 2016, coffee production in Vietnam has increased nearly 100-fold, from 18,400 tonnes in 1986 to 900,000 tonnes in 2000, and reached to 1.76 million tonnes in 2016. Between 90% and 95% of the volume has been exported every year. The key to Vietnam’s coffee success has been its focus on Robusta varieties. Robusta fetches a lower price than its higher-end counterpart, Arabica.

However, Robusta is far easier to grow because of its lower production costs compared to Arabica and its resistance to many of the pests and disease that affect Arabica. In addition, fertilizer and water inputs can be varied to affect yield without affecting the health of the plants, whereas Arabica plant health can be significantly damaged by drastic changes in inputs.

At the average of about 2.3 tonnes/ha, Vietnam’s coffee yield is considerably higher than that of any other coffee-producing country in the world. Vietnam has created a unique brand of high-intensity Robusta cultivation because its trees yield more beans per hectare than Arabica, which makes Vietnam the coffee-producing country with the highest yield. This is turn has boosted profitability for its coffee farmers, since many Vietnamese farmers harvest over 3.5 tonnes per hectare.

Table 3: Coffee output of Vietnam

| 2013 | 2014 | 2015 | 2016 | 2017 |

Total growing area (thousand ha) | 635.90 | 641.30 | 645.20 | 662.20 | 662.20 |

Harvested area (thousand ha) | 581.30 | 589.70 | 597.30 | 610.00 | 627.00 |

Output (thousand tons) | 1,381 | 1,408 | 1,453 | 1,458 | 1,529 |

% change in output | 4.5% | 2.0% | 3.2% | 0.34% | 4.87% |

Source: MARD of Vietnam

Vietnam’s coffee industry has been forced to look to the future in order to address its environmental and economic vulnerability. In 2014, the Vietnamese Government released the Vietnam Sustainable Coffee Plan up to 2020, and Vision to 2030. It includes concrete economic goals for the industry’s performance by 2020, and by 2030 in export turnover. The plan also sets specific environmental directives, including putting a cap on nationwide coffee cultivation at 600,000 hectares, exploring water-saving irrigation methods, as well as using environmentally friendly fertilizers and pesticide inputs that are safe for human.

These goals are an indication that Vietnam hopes to maintain its position as a coffee powerhouse, ensuring stable production conditions for the future. And another sign that Vietnam takes its coffee production seriously, the Government recently designated 10 December as the country’s national coffee day. The first celebration was organized on 10 December 2017 in the Lam Dong province, and the second was held on 10 December 2018 in Dak Nong.

2.4. Coffee processing

The coffee season begins on 1 October, which marks the end of rainy season and the coming of the dry season in southern Vietnam, as well as the time for coffee harvesting and processing when the coffee cherries are bright red, glossy, and firm. Cherries are mostly harvested by hand, either stripping both unripe and overripe cherries from the tree, or by selectively picking only ripe cherries from the tree and leaving behind unripe, green cherries to be harvested at a later time. In Vietnam, harvested is normally accomplished by stripping both unripe and overripe cherries from the tree.

The most common processing method applied in Vietnam is the dry method after cherries have been harvested. By this method, cherries are dried under the sunlight or in mechanical driers. At present, nearly 80% of post-harvest processing is by sunlight.

However, coffee farmers, producers and traders in the Central Highlands now increasingly use machines to dry cherries. The drying period is about 12 to 16 hours per batch and the humidity drops to 10% - 12%. The main raw materials used as fuel for driers are dried coffee husks or coal.

Meanwhile, large-scale coffee producers mainly use wet processing technology. This is the most advanced processing technology today, and is applied in many other countries in the world.

There are hundreds of mills all over the country with the technology for green bean processing, either by the wet or dry methods, mostly sited in the Central Highlands and Southeast regions. The design capacity of 1.5 million tonnes a year is sufficient to satisfy the demand for green bean processing in the whole country. In Dak Lak province for example, 16 plants with wet processing technology have been set up with a total annual capacity of over 64,000 tonnes of product.

Moreover, for intensive processing of coffee products (roasted, ground and soluble coffee) for added value, there are 176 facilities for roasted and ground coffee processing, with a design capacity of about 52,000 tonnes per year; 8 factories for pure soluble coffee processing, with a design capacity of 37,000 tonnes a year; while the design capacity of 11 facilities for mixed instant coffee processing reaches 140,000 tonnes per year. According to the Ministry of Agricultural and Rural Development, the Vietnamese coffee sector aims by 2020 to increase the share of processed coffee to up to 25% of total national coffee output, not only for export, but for domestic consumption also, in order to contribute more value addition to the income of the Vietnamese coffee sector.

- COFFEE EXPORT PERFORMANCE DURING THE LAST FIVE YEARS

3.1. Volume and value of exports

In recent decades, the world’s coffee output has increased year by year with the total exceeding the world’s demand, leading to falling coffee prices in international markets. Moreover, the fluctuation of the coffee export prices due to volume changes caused by climate change has directly affected the volume and value of coffee exports of Vietnam over the same period.

Major changes occurred in the volume and value of Vietnam’s exports in 2014/15 in comparison with 2013/14, and 2016/17 in comparison with 2015/16. Considering 2015/16, for example, the volume of exports rose substantially but the increase in value was modest compared to the previous year. The average export price of coffee in the first six months of 2018 was US$1,927/tonne, 14.8% lower than in the first six months of 2017.

Figure 5: Green Robusta price (October 2013 – May 2018)

Source: MARD

Despite the world’s economic difficulties and reduction in purchasing power in recent years, coffee exports from Vietnam have maintained a very high growth rate. During the period 2011-2017, the average annual coffee export growth rate was 8.2%, with turnover of around US$3 billion a year, accounting for over 10% of the country's total agricultural exports.

During the last decade, green beans accounted for more than 90% of Vietnam’s exported volume. However, exports of highly processed coffee have increased in recent years. In 2016, nearly 63,000 tonnes of roasted and soluble coffee products were exported.

Table 4: Vietnam’s coffee export

Coffee year | 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18f |

Export volume (thousand tons) | 1,469.06 | 1,256.64 | 1,566.77 | 1,385.49 | 1,400.00 |

% change | 18.10% | - 14.29% | 24.60% | - 11.46% | 0.72% |

Export value (million US$) | 2,909.40 | 2,481.83 | 2,701.99 | 3,036.13 | 2,700.00 |

% change | - 5.40% | - 14.78% | 8.87% | 12.59% | - 11.18% |

Source: VCCI

3.2. Exports by destination

Vietnam’s coffee is exported to ninety countries all over the world. The traditional consumption markets for Vietnamese coffee have been Europe and the United States of America. People in Asia traditionally drink tea, but consumption of coffee has thrived in recent years and the presence of chains of coffee shops has led to the creation of a large and growing coffee culture. As a result, the volume of Vietnam’s coffee exports to Asia has increased considerably, from less than 10% of the country’s total worldwide coffee exports ten year ago to 24% in 2016.

Table 5: Main export destinations of Vietnam’s coffee

Coffee year | 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | |||||

| Volume (thousand tonnes) | Value (million US$) | Volume (thousand tonnes) | Value (million US$) | Volume (thousand tonnes) | Value (million US$) | Volume (thousand tonnes) | Value (million US$) | Volume (thousand tonnes) | Value (million US$) |

Germany | 185.07 | 359.84 | 161.40 | 311.93 | 213.57 | 356.63 | 177.96 | 374.28 | 165.00 | 305.00 |

USA | 175.54 | 349.62 | 152.47 | 283.77 | 210.76 | 357.69 | 191.98 | 462.57 | 170.00 | 315.00 |

Italia | 126.67 | 246.12 | 118.31 | 231.72 | 133.50 | 230.28 | 131.95 | 284.72 | 140.00 | 270.00 |

Spain | 108.13 | 214.17 | 121.20 | 242.66 | 129.30 | 230.48 | 101.25 | 218.83 | 115.00 | 220.00 |

Japan | 81.37 | 166.55 | 76.17 | 151.49 | 100.77 | 176.49 | 91.04 | 199.14 | 105.00 | 215.00 |

Belgium | 147.29 | 271.98 | 64.37 | 132.47 | 60.89 | 109.16 | 71.16 | 148.94 | 50.00 | 95.00 |

Algeria | 57.79 | 113.51 | 210.89 | 441.79 | 63.78 | 107.57 | 62.77 | 132.57 | 75.00 | 140.00 |

Philippines | 37.55 | 71.96 | 34.64 | 65.84 | 36.11 | 59.63 | 23.73 | 48.48 | 30.00 | 55.00 |

Russia | 55.23 | 125.77 | 50.37 | 112.98 | 66.61 | 121.60 | 55.80 | 127.78 | 75.00 | 155.00 |

India | 41.15 | 78.93 | 33.11 | 60.89 | 43.23 | 70.46 | 45.15 | 92.34 | 55.00 | 100.00 |

France | 34.02 | 65.69 | 28.78 | 54.52 | 31.97 | 53.91 | 34.25 | 70.95 | 31.00 | 54.00 |

UK | 34.98 | 70.54 | 28.58 | 60.16 | 37.88 | 67.89 | 27.49 | 61.90 | 25.00 | 48.00 |

China | 31.24 | 58.66 | 24.26 | 43.88 | 31.30 | 51.35 | 12.05 | 24.97 | 14.00 | 25.00 |

Thailand | 22.97 | 44.83 | 32.84 | 63.39 | 31.33 | 54.04 | 43.43 | 86.52 | 37.00 | 69.00 |

South Korea | 33.55 | 67.56 | 27.56 | 54.62 | 27.25 | 46.37 | 33.69 | 73.04 | 27.00 | 51.00 |

Malaysia | 27.84 | 51.51 | 25.47 | 47.25 | 29.19 | 48.07 | 24.79 | 50.60 | 30.00 | 56.00 |

Mexico | 28.16 | 54.62 | 20.45 | 38.39 | 49.37 | 80.65 | 49.07 | 99.73 | 34.00 | 61.00 |

Indonesia | 15.27 | 30.95 | 6.16 | 11.46 | 19.43 | 30.63 | 4.51 | 9.82 | 67.00 | 120.00 |

Netherlands | 12.47 | 25.50 | 11.95 | 23.46 | 13.66 | 23.69 | 12.06 | 26.21 | 8.00 | 15.00 |

Poland | 12.66 | 24.10 | 14.96 | 28.32 | 15.37 | 25.70 | 14.01 | 28.17 | 8.00 | 15.00 |

Others | 200.14 | 416.99 | 12.70 | 20.84 | 221.50 | 400.70 | 34.25 | 414.57 | 229.00 | 496.00 |

Total | 1,469.06 | 2,909.40 | 1,256.64 | 2,481.83 | 1,566.77 | 2,701.99 | 1,385.49 | 3,036.13 | 1,490.00 | 2,880.00 |

Source: VCCI

3.3. Coffee and trade balance

For the last three decades, in conjunction with rice and cashew nuts, coffee has become a leading agricultural export product and has brought billions of US dollars annually into the country. This figure is large in terms of value and share in the total export turnover of the country. The Government’s policy of increasing investment in the development of all agricultural sectors for the coming years includes substantial amounts for extensive processing of roasted and soluble coffees to add value to the coffee sector. The goal of total coffee export value over the next decade is to reach US$6 billion a year.

Table 6: Vietnam’s coffee export and trade balance

Coffee year | 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 * |

National export (billion US$) | 146.07 | 160.29 | 170.42 | 202.97 | 220.00 |

Coffee export (billion US$) | 2.91 | 2.48 | 2.70 | 3.04 | 2.70 |

Share in national export | 1.99% | 1.55% | 1.58% | 1.50% | 1.16% |

Source: VCCI

* Estimate

3.4. Share of coffee in Gross Domestic Product

For many years, coffee has been one of the most important contributors to the revenue of Vietnam’s agricultural sector in particular, and to the national GDP as a whole.

The coffee industry has created more than half a million direct and indirect jobs, and has contributed the greatest share of thousands of households’ income in producing areas. Coffee export value has usually occupied around 15% in total agricultural export turnover, and the share of coffee has always exceeded 10% of agricultural GDP in recent years.

Table 7: Share of coffee in GDP

| 2013 | 2014 | 2015 | 2016 | 2017 |

National GDP (billion US$) | 171.22 | 186.20 | 193.24 | 205.28 | 223.86 |

Agricultural GDP (billion US$) | 34.21 | 36.64 | 36.50 | 37.23 | 38.31 |

Coffee GDP (billion US$) | 4.11 | 3.48 | 4.04 | 4.65 | 4.84 |

Share of Agricultural/National GDP | 19.98% | 19.68% | 18.89% | 18.14% | 17.11% |

Share of Coffee/Agricultural GDP | 12.00% | 9.50% | 11.06% | 12.48% | 12.63% |

Share of Coffee/National GDP | 2.40% | 1.87% | 2.09% | 2.26% | 2.16% |

Source: WB, Vietnam’s GSO & Customs Office

- STAKEHOLDERS IN THE COFFEE SECTOR

4.1. Farmers’ associations/cooperatives

The production of coffee in Vietnam is now about 95% from privately run farms, with the remaining 5% being managed by the state, which are also being gradually redistributed to small farmers. However, many collection, processing and export roles are still performed by State-Owned Enterprises (SOEs). Key stakeholders in the Vietnam coffee industry include:

- The Vietnam Coffee Corporation (VINACAFE) is the SOE umbrella company under MARD that manages 59 SOEs that cover a range of industries including 40 state farms totaling 27,000ha of coffee. These state farms work with 27 SOEs, including processors, traders, and service providers that offer credit, fertilizer, irrigation, research and roasting services. VINACAFE has taken over the supervision of the SOEs from MARD since 1995. It is now in a process of privatizing these enterprises. At present, the government controls only 5% of the coffee production area in Vietnam in the form of state-run farms.

- 71 cooperatives have been set up so far in the Central Highlands and other coffee-growing regions. These co-ownership members share the supply and source of seedlings, fertilizer, water supply and distribution markets.

- Private coffee farms: The majority of private coffee farms are smallholdings that comprise the bulk of production in the Vietnam coffee industry. It is estimated that around 85% of total coffee areas (about 480,000ha) are cultivated by households. Of this area, 63% is comprised of small farms with less than one hectare per household. This indicates that more than 640,000 smallholdings are involved in coffee production in Vietnam.

- Processors and exporters: Vietnam has over 100 registered coffee exporters, including a number of joint-venture processing and export operations with international partners. Most large multinational coffee trading houses and roasters are directly represented in Vietnam through direct investments or joint venture companies.

- Private business: A growing range of private businesses focusing on local coffee trading, fertilizer importation, resale and general farm supplies.

- The Vietnam Coffee - Cocoa Association (VICOFA), with more than 100 members, including some SOEs, 18 private companies, 16 large farms in Central Highlands, 26 FDI companies, 4 joint commercial banks, 01 commodity stock exchange and 01 scientific institute (WASI). Vicofa was formed in 1990 and was instrumental in the country’s membership of the International Coffee Organization (ICO) in 1991. The objective is to help organize the coffee sector and assist the government to develop coffee policies. It is presented as an independent business association, but is in reality more of a government-affiliated organization that represents Vietnam in international and regional overseas forums and is financed through its members and by the government.

4.2. Government involvement

The Ministry for Agricultural and Rural Development (MARD) is the key ministry for coffee. Various departments and organizations of MARD directly manage and oversee the coffee industry of Vietnam, such as Department of Crop Production (DCP), Agro-Processing and Market Development Authority (Agrotrade), International Cooperation Department (ICD), Vietnam Coffee Coordinating Board (VCCB), etc. There are a number of research and development institutions under MARD such as: the Institute of Policy and Strategy for Agriculture and Rural Development (IPSARD); the Western Agroforestry and Scientific Institute in Dak Lak (WASI); and Ba Vi Research Centre (BRC), specifically set up for Arabica research in North Vietnam. Provincial People’s Committees and their agencies for agriculture and forestry at lower levels provide direct administrative management. The Ministry of Industry and Trade plays a vital role in market access and economic global integration.

The Vietnam Bank of Agriculture and Rural Development (Agribank), which is the main form of credit for coffee farmers, is a government institution and has 1,600 branches in rural areas. Agribank estimates that it has 75% share of the credit market for coffee growers. In 2002 this market exceeded US$270 million.

- PROSPECTS FOR COFFEE PRODUCTION

5.1. An assessment of difficulties faced by the sector

Over the past several decades, coffee production in Vietnam has developed as a major export-oriented industry. The country is the world’s second biggest producer of coffee production and export. However, Vietnam coffee now faces with several challenges, the major one being:

- Climate change has brought about several disasters for coffee production in the country. These include a tropical storm in November 2007, and the record heat and drought in 2013, which disrupted most coffee-growing areas in the Central Highlands. In early 2016 El Niño conditions brought the worst drought in 20 years. Rains from December 2015 to February 2016 were 40% below the previous year’s level, and by mid-March reservoirs were 15% to 35% below average levels. According to the International Center for Tropical Agriculture (CIAT), rising temperatures and shifting rainfall patterns may cost Vietnam 50% of its current Robusta coffee production areas by 2050. Environmental limitations are expected to significantly reduce the land suitable for coffee trees, as average temperatures increase and the dry season becomes longer and hotter, reducing water availability. Experts agree the outlook appears bleak, but there is hope that the country can cope by using smart agricultural practices.

- About 50% of total coffee trees cultivating in Vietnam are between 10 to 15 years old. This is in the area where coffee trees are at their most productive and give the highest yield. In coming years, Vietnam's coffee production will be mainly based on this area. For the rest of the country, nearly 30% of coffee trees are between 15 to 20 years old and about 20% are more than 20 years old, beyond their most productive age, decreasing yields and outputs for farmers, season by season. If not renovated in the next few years, ageing trees will directly affect the productivity and quality of coffee in Vietnam.

- The area of newly planted coffee trees has increased significantly in the recent past, but most of these new plantations are not in the planning regions, and are mostly situated in inadequate areas, with shallow soil, steep slopes, lack of irrigation water, etc. Therefore, although the newly planted area has increased, achieving high economic efficiency because of low productivity and high production costs due to planting in unsuitable land.

- The intensive cultivation practices used in the past utilized excessive amounts of inputs (fertilizer, irrigation, etc.), in order to achieve maximum yield. Not only did coffee trees quickly become exhausted and lose productive capability, but such practices also resulted in severely polluted soil, leading to many diseases and pests, especially fungal ones and root nematodes.

- The form of production, small size, dispersion and relative independence of the farming households has resulted in a low quality and unstable production. The difference of investment in the various stages of coffee-harvesting and -processing between coffee producers has affected the quality of the entire coffee sector. Moreover, it is recommended that there should be one large dry mill for every 100 ha of coffee. This standard is still ‘far away’, even in potential resources areas for coffee as Dak Lak and Lam Dong. Standard storage spaces for coffee beans after processing are still lacking in quantity. As a result, quality certification is difficult to achieve.

- While coffee is a plant that needs lots of water, traditional but obsolete irrigation is still the main method used in most coffee-growing areas, causing serve ground-water loss. In many localities, the drilling of wells for irrigation has led to the destruction of ground-water resources and pollution of the soil, which is wasteful and ineffective.

- Harvesting coffee by stripping both unripe and overripe cherries from the trees, which is the customary method in the Central Highlands, is also recognized as one of the reasons for lowering the quality of Vietnamese coffee.

- The majority of the country’s coffee crop is Robusta, which fetches lower prices than premium Arabica, grown mainly in South America, a factor that limits export earnings.

In response to these challenges, Vietnamese policy-makers have been introducing long-term reforms of the country’s industry. In 2014, the Government mapped out the Sustainable Coffee Development Plan up to 2020, and Vision to 2030, an overall agenda aimed at sustainably managing economic and environmental resources for the coffee sector, increasing export earnings and ensuring stable production. The plan includes concrete economic goals for the industry’s performance, such as increasing intensive processing for added value to achieve US$6 billion in export revenue in the coming decade. It also sets out specific environmental directives, including a cap on nationwide coffee cultivation at 600,000 hectares, replacement of pest and disease resistance, rezoning coffee areas, exploring water-saving irrigation methods, as well as setting new environmental and safety standards for fertilizer and pesticide inputs.

Download full country profile of Vietnam: icc1249eprofilevietnam.pdf

| Mật khẩu | |

| Nhớ mật khẩu | Quên mật khẩu | Đăng ký | |